The Freedman's Savings and Trust Company and African American Genealogical Research

Federal Records and African American History (Summer 1997, Vol. 29, No. 2)

By Reginald Washington

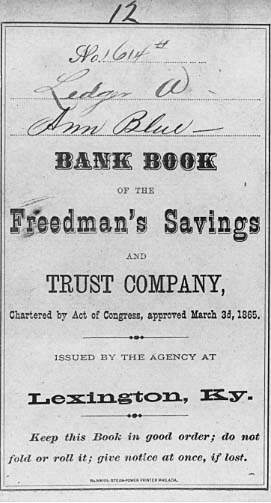

Among the most underused bodies of federal records useful for African American genealogical research are the records of the Freedman's Savings and Trust Company. Chartered by Congress in early 1865 for the benefit of ex-slaves, the surviving records relating to the bank and its collapse are a rich source of documentation about the African American family. In an effort to protect the interests of depositors and their heirs in the event of a depositor's death, the branches of what is generally referred to as the Freedman's Bank collected a substantial amount of detailed information about each depositor and his or her family. The data found in the files provide researchers with a rare opportunity to document the black family for the period immediately following the Civil War.

Background

In a meeting in New York on January 27, 1865, John W. Alvord, a Congregational minister and abolitionist, met with more than twenty philanthropists and leading members of the business community to explore the idea of establishing a savings bank for the benefit of African American soldiers. Alvord, who had worked with these soldiers in a variety of humanitarian ventures, informed the group that many black soldiers who were receiving back pay and bounty payments for enlisting in the service had no safe place to deposit their money. Others, who lacked experience in the business of managing their own affairs, were either squandering their pay or being victimized by swindlers. Alvord proposed a plan to establish a "benevolent" banking institution that would provide African American soldiers with a secure place to save their money and at the same time encourage "thrift and industry" in the African American community.(1)

The Alvord plan was not the first attempt to assist the African American soldier to save. A few states in the North had instituted an "allotment" system that allowed both black and white soldiers to have portions of their pay deducted each month and sent to relatives or held by military officials until the soldiers left the service. Several concerned military commanders had also made attempts to assist African American soldiers, as well as civilians, to save for the future. In 1864, for example, Gen. Rufus Saxton, created the Military Savings Bank at Beaufort, South Carolina, eventually known as the South Carolina Freedmen's Savings Bank, to secure the deposits of African American soldiers and civilians. In the same year, Gen. Benjamin Butler established a similar bank in Norfolk, Virginia. In Louisiana, Gen. Nathaniel Banks established the "Free Labor Bank," which maintained deposits from thousands of African American soldiers and former slaves who worked on plantations under the control of the federal government. While these early efforts met with some success, Alvord saw them as temporary measures. In his view, a permanent savings bank was needed if African Americans were to make a successful transition from slavery to freedom and to be truly incorporated into the economic mainstream of American society.(2)

After several reviews of the Alvord proposal, the New York group voted overwhelmingly for the plan and concluded that a charter should be secured from the federal government. On February 13, 1865, with the assistance of Senator Charles Sumner of Massachusetts, a bill to incorporate the Freedman's Savings and Trust Company was brought before Congress. After a brief discussion and some confusion about where the bank would be located, "An Act to Incorporate the Freedman's Savings and Trust Company" was signed into law by President Abraham Lincoln on March 3, 1865.(3)

The act had a clear objective and purpose: a simple savings institution created primarily for former slaves and their descendants. The deposits received by the bank--with the exception of a fund set aside for operating costs and other emergencies--were to be invested in "stocks, bonds, Treasury notes, or other securities of the United States." The charter suggested that "no loans would be made" and that "all the assets of the Bank were owned by the depositors in proportion to the deposits of each." A board of fifty trustees was authorized to managed the bank, and the company's books "were to open for inspection and examination to such persons as Congress would appoint."(4)

While the act made no provisions for branch offices outside the District of Columbia, Alvord always planned that the bank open branches where there were large African American communities, especially in the South. By January 1866, with its headquarters in New York (moved to Washington, D.C., in 1867) and the assets of the two military banks at Norfolk and Beaufort transferred to the company, Alvord and other bank officers moved with missionary-like zeal to open branches in Richmond, Charleston, Savannah, New Orleans, Vicksburg, and Houston. Between 1865 and 1871 the Freedman's Bank opened some thirty-seven branch offices in seventeen states and the District of Columbia. In less than a decade, an estimated seventy thousand depositors had opened and closed accounts, with bank deposits totaling more the fifty-seven million dollars.(5)

In early 1874, however, overwhelmed by the effects of a 1870 amendment to its charter that changed its loan and investment policy, the Panic of 1873, problems of overexpansion, mismanagement, abuse, and outright fraud, the Freedman's Bank was on the brink of collapse. In March 1874, in an effort to maintain the confidence of its depositors, who had made "runs" on several of the branch offices, bank officials elected Frederick Douglas as president. Unaware of the true state of the bank's affairs, Douglass invested ten thousand dollars of his own money to demonstrate his faith in its future. After a few months of assessing the condition of the company, however, Douglass realized that he was "married to a corpse" and recommended to Congress that the bank be closed.(6)

Congress, by an act of June 20, 1874, authorized the trustees, with approval of the secretary of the treasury, to appointed a three-member board to take charge of the assets of the company and to report on its financial condition to the secretary of the treasury. On June 29, 1874, less than a week after the act passed, the Freedman's Bank closed. In 1881 Congress abolished a board of three commissioners and authorized the secretary of the treasury to appoint the comptroller of the currency to oversee the affairs of the bank. The comptroller was required to submit annual reports to Congress. The final report of the comptroller was made in 1920.

The closure of Freedman's Bank devastated the African American community. An idea that began as a well-meaning experiment in philanthropy had turned into an economic nightmare for tens of thousands African Americans who had entrusted their hard-earned money to the bank. Contrary to what many of its depositors were led to believe, the bank's assets were not protected by the federal government. Perhaps more far-reaching than the immediate lost of their tiny deposits, was the deadening effect the bank's closure had on many of the depositors' hopes and dreams for a brighter future. The bank's demise left bitter feelings of betrayal, abandonment, and distrust of the American banking system that would remain in the African American community for many years. While half of the depositors eventually received about three-fifths of the value of their accounts, others received nothing. Some depositors and their descendants spent more than thirty years petitioning Congress for reimbursement for losses.(7)

Microfilmed Records

The surviving records of twenty-nine branches of the Freedman's Bank are reproduced on National Archives Microfilm Publication M816, Registers of Signatures of Depositors in Branches of the Freedman's Savings and Trust Company, 1865-1874. This publication reproduces fifty-five volumes of signatures of and personal identification data about thousands of depositors who maintained accounts with the bank. While the amount of information collected by each branch varied, the records generally show the name of the depositor; account number; age; complexion; date of application; place of birth; place raised; occupation; spouse; children; names of parents, brothers, and sisters; remarks; and signature. Some of the earlier volumes contain the names of former owners or mistresses and the plantations where depositors resided. Some entries include copies of death certificates. The signatures of depositors are arranged alphabetically by name of the state, thereunder by name of the city in which the branch was located, thereunder by date when the account was established, and thereunder by account number.

The registers of signatures are not indexed, however. National Archives Microfilm Publication M817, Indexes to Deposit Ledgers in Branches of the Freedman's Savings and Trust Company, 1865-1874, reproduces forty-six volumes of indexes to deposit ledgers that provide the names and account numbers of depositors in twenty-six branch offices of the Freedman's Bank. Some volumes show the amount of the deposit. The deposit ledgers themselves are not in the National Archives, and it is not known if they still exist. The indexes are arranged alphabetically by state and thereunder by name of the city where the branch was located. The names are indexed, for the most part, alphabetically by the first letter of the surname. Because the index entries include account numbers, researchers can use them as a rough finding aid to the registers of signatures. See appendix.

Researchers, however, should proceed with caution when using the indexes. More than one index exists for some bank offices, and some indexes are not arranged in strict alphabetical order. It is therefore necessary to examine every name under the letter of the alphabet beginning the surname. Some indexes do not list all depositors whose surnames appear in the registers of signatures; many account numbers are missing; and in some instances account numbers assigned to depositors in the index are different from those in the signature cards. In such cases, it is necessary to search entire rolls of signature cards for bank offices where an ancestor resided. If there were no bank offices in the state and city where an ancestor lived, researchers should search for information about ancestors in the records of branch offices in neighboring states and cities.

The National Archives microfilm collection of the Freedman's Bank records also includes M874, Journal of the Board of Trustees and Minutes of Committees and Inspectors of the Freedman's Savings and Trust Company, 1865–1874. The minutes include those of the Agency Committee, Finance Committee, and Examining Committee, although some committees' minutes are incomplete. An Educational and Improvement Committee was also established, but no minutes for it have been found. Entries in the journal and the minutes are arranged chronologically by the date of the meetings. While these records have little or no genealogical value, they are, nevertheless, useful for studying the administrative activities and financial decisions of the company.

Unmicrofilmed Records

Despite the dismal financial state of the Freedman's Bank when it closed, the three commissioners appointed to liquidate the assets of the bank and repay its depositors announced the first dividend payments on November 1, 1875. Between 1875 and 1883, the commissioners and the comptroller of the currency declared five dividend payments, amounting to 62 percent of what was actually owed to depositors. To receive dividend payments, depositors had to mail in their passbooks with their return address to Washington. Of the 61,131 depositors eligible to receive the dividends, only 29,996 sent in passbooks. Most of these depositors were holders of large accounts. Many small depositors—some 31,000—never requested their dividends. Other depositors had died or moved and could not be located by commissioners.(8)

Many depositors grew to distrust the federal government or became frustrated with the bureaucratic and costly procedures required to obtain dividend payments. For example, in cases where depositors died, heirs had to submit an affidavit, executed before a notary public, swearing that they were the true heirs or descendants of the depositor.9 In addition to the affidavit, depositors or heirs who made claims but were unable to produce deposit books had to complete a questionnaire responding to the same questions that were asked of depositors at the time they opened their accounts with the bank. The responses were then compared with signature records for accuracy. For many claimants who lacked resources or could not read or write, meeting the government's requirements was extremely difficult.

Nonetheless, among the "Letters Received by the Commissioners of The Freedman's Savings and Trust Company and by the Comptroller of the Currency, 1870–1914," researchers will find numerous letters, passbooks, and questionnaires that were sent to commissioners regarding individual accounts and dividend payments. Also interspersed among these files are legal papers, dividend checks, payrolls, vouchers, loan papers, bonds, and insurance policies and deeds. These records have not been microfilmed and have a variety of arrangement schemes. The passbooks, for example, are arranged alphabetically by the city and thereunder alphabetically by the name of the depositor; the questionnaires are arranged alphabetically by the name of the depositor or heir; and the miscellaneous papers are unarranged. While most of the information found in the letters received relates to the liquidation of the bank, the records should be examined for genealogical data concerning depositors and their heirs. In some cases, these unfilmed records may be the only records available that document an ancestor's relations with the Freedman's Bank.

The thirty-four volumes of "Letters Sent by Commissioners of the Freedman's Savings and Trust Company and by the Comptroller of the Currency as Ex Officio Commissioners, 1874–1913," like the letters received, relate primarily to the liquidation of the Freedmen's Bank. Some documentation in the files, however, concerns responses by commissioners to inquiries from depositors and their descendants about individual accounts. Also included are letters sent by commissioners and the comptroller soliciting the help of African American community leaders and other local officials in locating depositors or their heirs who were due dividend payments. The letters are arranged chronologically with an index in each volume.

The sixteen volumes of "Dividend Payment Records, 1882–1889," are arranged by the city in which the branch office was located and thereunder by the depositor's account number. The records contain the amount a depositor had in his or her account when the bank closed and the number and amount of dividend payments received. Researchers examining these files will need to know the account numbers obtained from the signature records and the indexes to deposit ledgers.

Freedman's Bank Depositors

To encourage deposits and to convince the African American community that their money was in safe hands, Freedman's Bank officials used a number of methods and tactics. Passbooks and other bank literature contained numerous slogans and poems "on temperance, frugality, economy, chastity, the virtues of thrift & savings." Bank advertisements frequently included the names of prominent government officials, such as Abraham Lincoln and Oliver Otis Howard, often to the point of misleading depositors into believing that their deposits were backed by the federal government. Depositors were constantly reminded during public meetings and other bank-sponsored gatherings that the bank was under the charter of Congress, and thus under its complete protection. One writer remarked, "Small wonder that most freedmen never knew that the only power Congress had over the Bank was the right to inspect the books if it wished—which it didn't."(10)

With such assurances that their deposits were safe, African Americans from a wide variety of backgrounds and occupations opened accounts with the Freedman's Bank between 1868 and 1874 at a phenomenal rate. Farmers, laborers, cooks, janitors, nurses, porters, seamstresses, carpenters, washers, draymen, gardeners, shoemakers, blacksmiths, and barbers deposited their savings. For many of these depositors, who were for the first time in their lives receiving wages for their services, owning a bank account was a great source of pride and excitement.

Perhaps one of these enthusiastic depositors was Dilla Warren. Warren opened an account with the New Bern, North Carolina, branch on November 2, 1869. Her signature records not only provide an interesting example of the value of the Freedman's Bank records for genealogical research but also give a tragic example of the effect slavery had on the stability of the African American family. Warren, who turned fifty on February 17, 1869, was born in Chowan County, North Carolina. Despite being crippled, she was self-employed and made her living from sewing, knitting, washing, and ironing. Her husband, Pompey Nixon, was "sold away" seventeen years before the Civil War. Her signature records list eleven of her fifteen children, including those who either died or were sold: Harriet Ann (sold away), Ned Clark (sold), Oscar and Andrew (twins, both dead), Flora(dead), Joseph (dead), Ruess (dead), Lilla (dead), James Clark, and Jane and Maria (twins, both dead). Warren's father, Ned Clark, was sold thirty years before the Civil War. Her mother, Harriet Nixon, along with her two brothers, Ned and Allen, was sold seventeen years before the war. Another brother, Andrew M., was killed by lighting. Warren's signature records also provide the names of her two sisters, Ann Carter (sold thirty-five years before Warren opened her account) and Maria Gregory. Warren indicated that at the time of her death, any money in her account should be given to Edward Paxton, the son of her deceased brother, Andrew.(11)

James Clinket (or Clinkot) deposited $225 in the District of Columbia branch on January 27, 1866. Born in King George County, Virginia, Clinket's former owners were Pinsett and Louisa Taylor. He and his wife, Julia, had three children: Mary S., Patsy, and Isaac. Clinket was among several depositors at the District of Columbia branch who listed their residence as Freedmen's Village.(12) Freedmen's Village was one of a number of contraband camps established in the Washington area in the early 1860s under the jurisdiction of various entities of the War Department. Between 1865 and 1870, the Bureau of Refugee, Freedmen, and Abandoned Lands, commonly referred to as the Freedmen's Bureau, administered the village's affairs. The village served as refuge for thousands of fugitive slaves and other destitute freedmen, who came largely from Maryland and Virginia. Located near Arlington Heights, Virginia, on the estate formerly owned by Confederate Gen. Robert E. Lee, the camp stood as a "national showcase." Dotting the grounds were some fifty dwellings, a hospital, a home for the indigent, a school, a chapel, a variety shop, and several parks.(13)

To promote "self-efficiency and industry" among its residents, all "able-bodied" men and women were required to work, and those who could, paid "house rent."(14) While Clinket's signature records do not mention his age or occupation, a September 1866 Freedmen's Bureau report of persons hired at Freedmen's Village indicates that Clinket--who was thirty-nine years old at the time—worked as a laborer at the camp, earning eight dollars a month. In another undated bureau report (probably 1866) showing the number of village residents who rented land, Clinket is listed as having rented five acres at ten dollars a year.(15)

At the branch office in Augusta, Georgia, Stephen Brown, a forty-nine-year-old farmer, opened an account on January 21, 1871. Brown, who was born in the Barnwell District of South Carolina, lived in Land Hills, Georgia, with his second wife, Henrietta (his first wife is listed as Lidney). His son, Wilson Brown, apparently "went off" after Emancipation. Brown's mother and father were recorded as Hetty Jacob and Nixon Brown (dead). Also listed were his three brothers: Sam Flowers (dead), Dick Brown, and Brister Brown (dead). Brown's five sisters and their husbands were also documented in the files: Dilsey (wife of Dick Dunbar), Becky (wife of Cicero Campbell), Charlotte (wife of Lang Jenkins), Nanny (wife of Frank Wood), and Jane (wife of William Cook).(16)

Stephen Brown, like many former slaves who held accounts at the Freedman's Bank, were not only able to amass small sums of money during slavery but managed to accumulate personal property as well. During the Civil War, hundreds of ex-slaves, free blacks, and whites had property seized by Federal troops as they advanced through the South. Brown filed a claim in 1871 before the Commissioners of Claims seeking compensation for a mule, hogs, corn, and bedding taken by "Yankee" soldiers from his owner's plantation. The Commissioners of Claims, commonly referred to as the Southern Claims Commission, was established by Congress on March 3, 1871, to review the claims of citizens who had property taken by Union forces and make recommendations for payment. Persons who submitted claims were required to show clear proof of ownership and provide satisfactory evidence that they had remained loyal to the federal government throughout the war. Brown told how he and his wife had been able to accumulate the property in his claim from the sale of crops produced from land set aside for them by their owner, John Lawson. In an attempt to convince commissioners of his loyalty to the federal cause, Brown alleged that he had received one hundred lashes from his owner for hiding a Yankee soldier in his home. In the end, though, Brown's claim was rejected.(17)

The depositor most sought after by the Freedman's Bank, particularly during the early years of expansion, was the African American soldier. The back pay and bounty money of these soldiers composed the bulk of the first deposits in many of the branch banks. Bank cashiers were instructed to be present whenever soldiers were being paid, and they worked closely with Freedmen's Bureau distribution officers--who by an act of Congress of March 1867 were given the sole responsibility for distributing the back pay and bounties of African American soldiers—to secure whatever portion of a soldier's money they could. In a number of bank branches—Vicksburg, Mobile, Charleston, Jacksonville, Norfolk, and Louisville—cashiers doubled as bureau distributing officers.(18) Cashiers were not the only bank officials who held dual positions at both the bank and the bureau. John Alvord himself served as president of the bank while holding down the position of general superintendent of education of the bureau. This close relationship with the Freedmen's Bureau added to the depositors' belief that the Freedman's Bank was a federal government institution.

The signature records of African American soldiers are perhaps one of the best examples of how documentation found in one body of federal records can lead a researcher to additional information in the records of another. One such record is the signature file for Jacob Reiley. Reiley, a twenty-two-year-old who had served with Company B of the Thirty-third United States Colored Troops (USCT), opened an account at the Savannah, Georgia, branch on April 6, 1866. Although living in Screven County at the time he opened his account, Reiley was born in Augusta, Georgia, where he was owned by Josiah Sibley. His signature records indicate that while in the military he had been a cook for General Sherman. Reiley's file gives the names of his stepfather, George Scott, and his mother, Tina. Also listed are his brother, Sandy, and three sisters, Alice, Amanda, and Cynthia. The file indicates that his natural father (no name given) resided in the Barnwell District in South Carolina.(19)

The information in Reiley's signature records, identifying the company and regiment in which he served, can be used by his descendants to search for additional information about him among Civil War military records maintained at the National Archives. The National Archives holds military and pension records for some of the more than 185,000 African Americans who served with the USCT. Reiley enlisted on January 11, 1865, and received a one-hundred-dollar bounty payment when he was discharged on January 31, 1866, approximately three months before he opened his account with the Freedman's Bank. He applied for a pension on November 22, 1893, and was granted ten dollars a month. While Reiley's signature records only revealed that his natural father resided in the Barnwell District of South Carolina, his pension file indicated that his father was Aaron Reiley and that he was formerly owned by a Bill Eve; Reiley's mother was owned by Josiah Sibley. According to his pension records, Reiley died on December 28, 1919, and his wife, Mary, filed to complete the pension on June 28, 1920.(20)

Bank branches not only solicited the deposits of African American adult civilians and soldiers, they also encouraged schoolchildren to make deposits and routinely "preached" to them about the importance of work and saving. Schoolchildren responded to the call and opened accounts ranging from as little as five cents to as much as twenty-five cents. In the Augusta, Georgia, branch, nearly 25 percent of the depositors were children. William Green, a six-year-old born in Hamburg, South Carolina, opened an account in the Augusta branch on January 27, 1871. (The account appears to have been opened on his behalf by his mother, Clarissa). Green attended a school in the city under the direction of a John Gardner. In addition to his parents, Monroe and Clarissa, his signature records list his three uncles (Henry, Reuben, and Jack) and three aunts (Patsy, Amy, and Emmeline). Green's mother, who washed and cooked for a living, opened a separate account on July 20, 1872. Her file provides the names of four of William's brothers and sisters not mentioned in his account records: John Thomas, Winny Thomas, Sarah (dead), and Mat (dead). Four more aunts and uncles were also named: Fanny, Dafney, Elvira, Patience, Richard, and Solomon. Mrs. Green also provided the names of her father and mother, Solomon (dead) and Phoebe. Her uncle, Steward, and grandfather, Billy, were also recorded in her file.(21)

African American churches, private businesses, and beneficial societies also maintained accounts at the Freedman's Bank. These institutions often took the lead in making deposits and were the driving force behind getting many individual depositors to open accounts. When the Freedman's Bank closed, however, many of these institutions, particularly the churches and beneficial societies, had to suspend or drastically curtail vital services, thus adding to the social and economic woes of the African American community. While files of organizations generally contain very little information about the institutions, they do identify leading officials, many of whom also maintained their own personal accounts.

The Union Church of Baltimore County, for example, opened an account at the Baltimore, Maryland, branch on March 24, 1868. The signature records provide the names of the board of trustees: Samuel Bruce, Nicholas Cross, Samuel Unsen, Alfred Dorsey, and Charles Johnson. The Reverend John H. Spriggs, whose signature appears on the file, apparently opened the account. Reverend Spriggs, a widower, also opened a personal amount on the same day. According to his records, he lived at 78 Sarah Ann Street with his three children: Clarissa Ann, Samuel Henry, and James Edward. Spriggs requested that in the event of sickness or death, a Miss Adeline Watts was the only person authorized to draw on his account.(22)

Access to the Records

The Freedman's Bank records are a part of Record Group 101, Records of the Comptroller of the Currency. Because of the bank's close association with the Freedmen's Bureau, researchers often confuse these records with those of the bureau, which is a separate body of records, Record Group 105. The microfilm collection of the Freedman's Bank records are available in the National Archives buildings in Washington, D.C., and College Park, Maryland. The unfilmed records are available only at College Park. Send written inquires regarding these records to the Textual Reference Branch, National Archives at College Park, MD 20740-6001. Some of the regional records services facilities may also have copies of the microfilmed records; however, researchers should contact the nearest region for information concerning their availability.

Notes

1. Carl R. Osthaus, Freedmen, Philanthropy, and Fraud: A History of the Freedman's Savings Bank (1976), pp. 1–2.

2. Ibid., pp. 2–3.

3. Ibid., pp. 4–5.

4. Ibid., pp. 5–6.

5. Walter L. Flemming, The Freedman's Savings Bank: A Chapter in the Economic History of the Negro Race (1927), pp. 33–34.

6. Abby L. Gilbert "The Comptroller of the Currency and the Freedman's Savings Bank," Journal of Negro History 57 (April 1972): 130–131.

7. Several committees of Congress investigated the affairs of the Freedman's Bank and received petitions from persons who sought compensation for losses suffered when the bank failed. Information concerning these matters can be found among the records of the U.S. Senate (Record Group 46) and the U.S. House of Representatives (Record Group 233). Researchers should also examined the Congressional Serial Set for published reports and documents regarding Freedman's Bank.

8. Paula K. Byers, African American Genealogical Sourcebook (1995), p. 63.

9. Ibid., p. 63.

10. Osthaus, Freedmen, Philanthropy, and Fraud, p. 56.

11. Signature records of Dilla Warren, No. 1333, New Bern, North Carolina, Registers of Signatures of Depositors in Branches of the Freedman's Savings and Trust Company, 1865–1874 (National Archives Microfilm Publication M816, roll 18), Records of the Office of the Comptroller of the Currency, RG 101, National Archives and Records Administration, Washington, DC (hereinafter, records in the National Archives will be cited as RG___, NA).

12. Signature records of James Clinket, No. 267, District of Columbia, M816, roll 4, RG 101, NA; See also signature records of Stephen Bailey, No. 17, M816, roll 4, RG 101, NA; Robert Law, No. 265, M816, roll 4, RG101, NA; Henry Lomax, No. 266, M816, roll 4, RG 101, NA; Mary Jane Jones, No. 268, M816, roll 4, RG 101, NA.

13. Joseph P. Reidy, "Coming from the Shadow of the Past: The Transition from Slavery to Freedom at Freedmen's Village, 1863-1900," The Virginia Magazine 95 (October 1987): 403–411.

14. Ibid., pp. 413–414.

15. Monthly Report of Persons and Articles Hired at Freedmen's Village, Office of the Assistant for the District of Columbia, September 1866, Entry 569, Records of the Bureau of Refugees, Freedmen, and Abandoned Lands, RG 105, NA; See also tabular statement showing the number of acres of land on the Arlington estate rented to freedpeople, RG 105, NA.

16. Signature records of Stephen Brown, No. 2407, Augusta, Georgia, M816, roll 7, RG 101, NA.

17. Claim of Stephen Brown, Office 192, Report 5, Disallowed Case Files of the Southern Claims Commission, 1871–1880, Records of the U.S. House of Representatives, RG 233, NA; For a discussion of African American claims before the Southern Claims Commission, see Reginald Washington, "The Southern Claims Commission: A Source for African-American Roots" Prologue: Quarterly of the National Archives (Winter 1995), vol. 27, no. 4, pp. 374–382.

18. Osthaus, Freedmen, Philanthropy, and Fraud, p. 27.

19. Signature records for Jacob Reiley, No. 153, Savannah, Georgia, M816, roll 8, RG 101, NA.

20. Compiled Military Services Record of Jacob Reiley, private, Co. B, Thirty-third USCT (First South Carolina Volunteers), Records of the Adjutant General's Office, RG 94, NA; Civil War pension file of Jacob Reiley, private, Co. B, Thirty-third USCT (First South Carolina Volunteers), WC 894620, Records of the Veterans Administration, RG 15, NA.

21. Signature records of William Green, No. 2410, Augusta, Georgia, M816, roll 7, RG 101, NA; For the signature records of Clarissa Green, see signature card after account No. 4687, Augusta, Georgia, M816, roll 7, RG 101, NA.

22. Signature records of the Union Church of Baltimore County, No. 6258, Baltimore, Maryland, M816, roll 13, RG 101, NA.